Table of Contents

ToggleYou can be either a weekend sport cycling aficionado or just casually ride into the woods for some ride-outs. Yet, in most cases, dirt bike insurance will make the distinction between a minor issue and financial ruin. In this article, we’ll be discussing how much dirt bike insurance costs, the things that may influence your insurance on a dirt bike, and the type of coverage that you might require. More importantly, it will touch on how Apollino owners could find customized options that would be best suited to their riding style. You would now be armed with the right questions to ask when getting your next quotes for insurance.

Before we start going through dollars and cents, let’s just go back to the very basic idea behind dirt bike insurance: when you need it, and how it works.

Whether or not you need your dirt bike insured totally depends on your location, mode of riding, and whether or not the bike is street legal. In some parts of some states or countries, you need to have insurance for dirt bike if you ride on public roads or certain public trails. Most commonly, when it comes to insurance statutes, it has something to do with licensing rules. For example, if a bike is licensed for road use, it usually requires minimum liability coverage. Probably you would not have to insure your bike if it is only used on private land, be it your land or a private motocross. But it will protect you from having to pay out-of-pocket when your bike is stolen or damaged in a crash or someone gets injured, even if not legally required to do so.

Let’s discuss a few regions’ legal requirements:

United States: Most states require liability insurance if your dirt bike is street legal; off-road bikes on private property often don’t need coverage.

Canada: Provinces like Ontario require liability insurance for off-road vehicles on public land; private land use may not need it.

United Kingdom: Road-legal dirt bikes must be insured; using one off-road without insurance is allowed only on private land.

Australia: Laws vary by state; public road or trail use usually requires compulsory third-party insurance, but private use may not.

European Union: Road use requires at least third-party insurance; off-road use rules vary by country, but often don’t require coverage.

In general, there are a few basic types of policies. Liability insurance covers the damage or injury done to other persons or property caused by an accident under their coverage. Collision insurance provides payments for all repairs needed for your motorcycle after an accident, no matter what caused the accident. Comprehensive coverage protects against loss caused by theft, vandalism, and fire. Some policies also include medical payments coverage, which would cover injuries for you and your passenger, regardless of the driver’s fault. You may find other optional add-ons such as accessory coverage for after-market parts, roadside assistance for street-legal bikes, and competition coverage for racing.

Let us take a look at price types and ranges from basic liability to complete coverage.

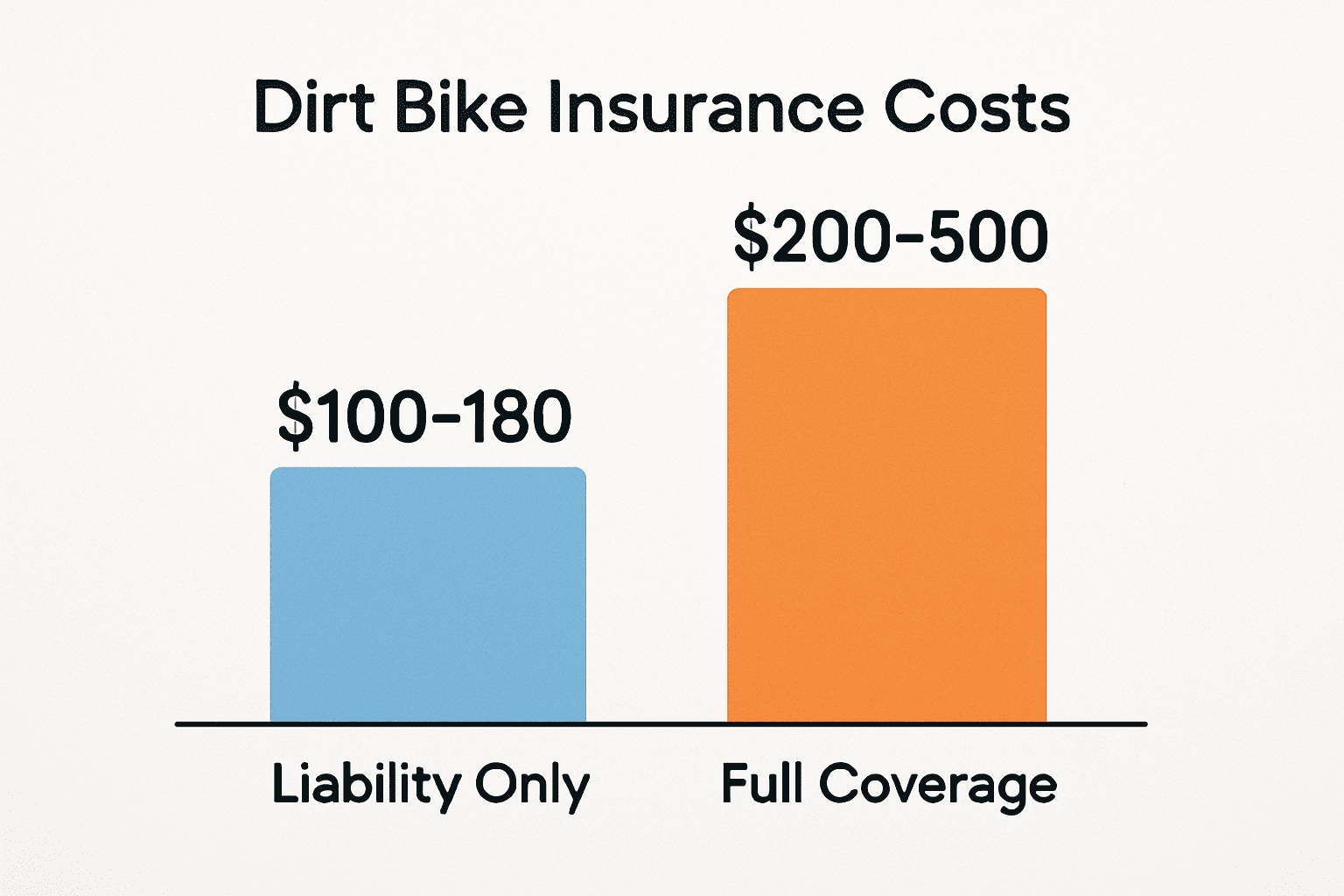

About USD 8-15 per month, that is USD 100-180 annually, for liability coverage only. Full coverage, which usually consists of every liability, collision, and comprehensive, can get as high as USD 200-500 a year. These policies vary, though, from state to state and region to region. The more urbanized places where theft and accidents happen more frequently would have higher premiums. Rural areas would usually have lower premiums, except in cases where certain counties are infested with extremely severe weather, like floods or wildfires, to raise risk points for the insurers.

Street-legal dirt bikes are costlier to insure since they are exposed to about the same risk as any other vehicular traffic-notably, traffic accidents, liability claims, and compliance with stricter requirements on off-road bike insurance. Off-road-only dirt bikes usually come at lower costs when it comes to insurance, but their coverage is limited. Theft or any other damage not covered may arise from some event other than a crash; this could be a garage fire or vandalism. Normally, they will be excluded from coverage unless the insured garners additional protection.

The following factors make up the rate for the insurance; they are not just some random numbers.

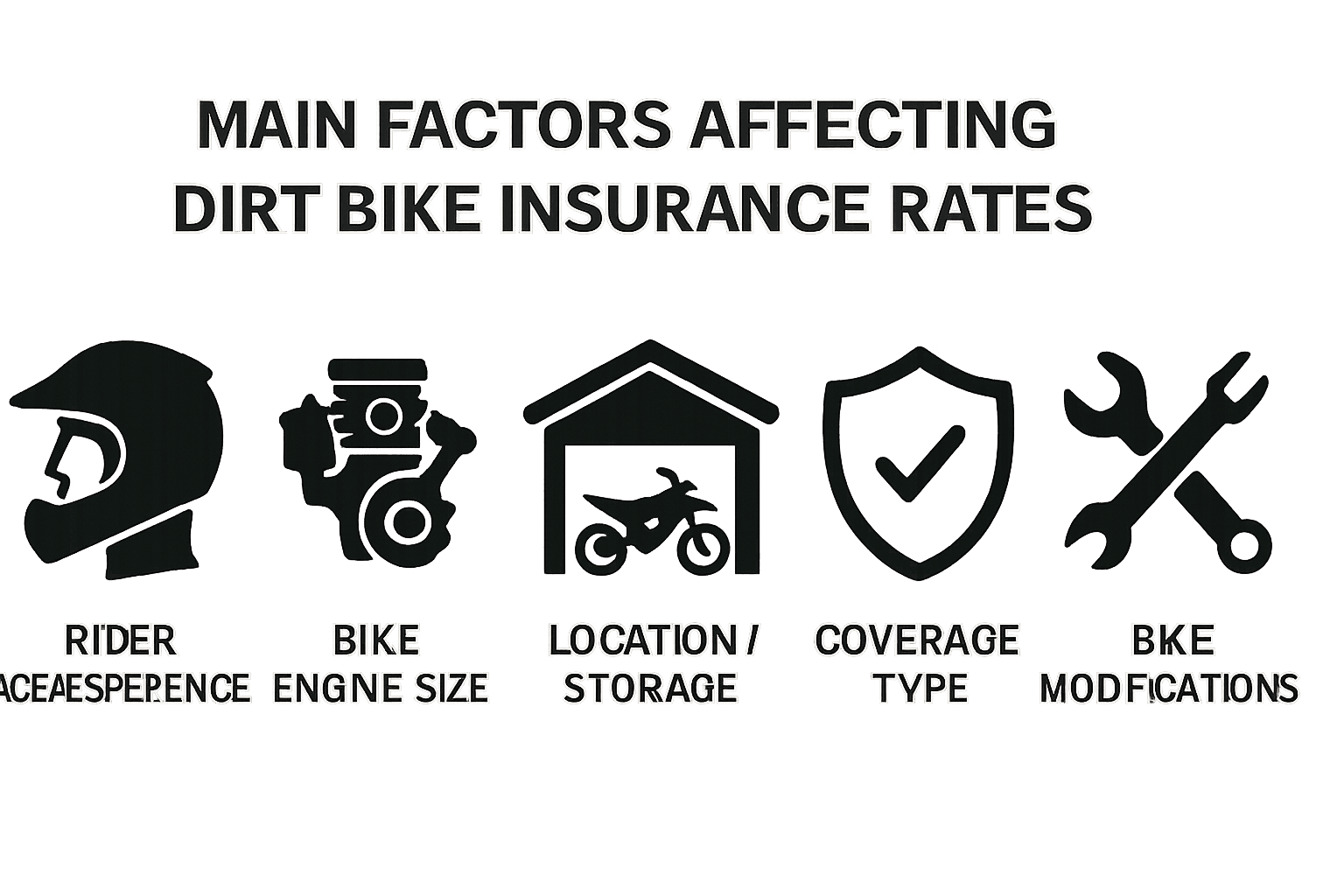

Age, riding history, and past incidents while riding are some of the factors that determine your premium. Young riders usually pay the most because of less experience and higher statistics of crashes. Taking a certified safety course can lower the premium, and the coming years of clean riding can earn some loyalty discounts with the insurance providers.

Cost enumeration of insuring dirt bikes is bike brand, model, and engine size. From the perspective of insurers, performance bikes with big engines are risky because they are able to reach speeds higher than those of an average rider, and these usually incur expensive repairs. For example, a 450cc competition-ready would most likely take more to insure than a 150cc trail bike. Insurers will also probably consider whether your bike is a two-stroke or four-stroke, as performance characteristics might also be related to accident risk and frequency of repairs.

Your location matters when it comes to where you store and ride your bike. Living in a high-theft area could impact your premiums, particularly if your bike is stored outside. Your riding style really matters, too. Casual weekend trail riding is less risky than frequent motocross racing or high-speed enduro events.

The broader coverage you select, the higher your premiums will most likely be. Indeed, full coverage is much more expensive than liability-only coverage, but it includes so much more. Formulating a higher deductible means that your premium gets lower; however, you have to pay more out of pocket for a claim.

Any aftermarket modifications can boost both your premium and coverage needs, especially high-value upgrades like custom suspension, racing exhausts, or navigation systems, which internalize theft and repair costs when the bike gets stolen. Another thing, just like modifications, any uninsured accessories put the risk of losing them without any settlements.

Most of the time, lowering insurance costs depends on convincing the insurers that you are a lower-risk rider.

If you have your dirt bike insurance bundled with your auto or homeowners policy, most insurers give you a discount. This can save money and make billing easy.

Insurers reward riders who take precautions to prevent theft. It will include putting your bike in a locked garage with an installed alarm system or using a steel gauge lock.

Not only does a course from a reputable motorcycle safety program help you improve your riding skills, but it can also lower your insurance. Some carriers will also give discounts for having certified safety gear on hand, like DOT safety helmets and armored riding jackets.

Here’s a quick comparison of some popular insurers and their typical offerings:

| Provider | Price Range (Annual) | Key Coverage Features | Customer Rating (out of 5) |

| Progressive | $150–$500 | Broad off-road & street-legal coverage, custom parts protection | 4.3 |

| GEICO | $120–$450 | Competitive liability rates, multi-policy discounts | 4.1 |

| Markel | $200–$550 | Specialized off-road coverage, race event add-ons | 4.4 |

| Nationwide | $180–$500 | Comprehensive theft/fire, flexible deductible options | 4.0 |

Specialized off-road insurers like Markel often include competition coverage and higher accessory limits. General providers such as GEICO and Progressive may offer better rates if you’re bundling with other policies. The right choice depends on whether your riding is primarily competitive or recreational.

Most of the Apollino models are much lighter and ergonomically designed for easier handling, so they at times translate to making many repairs. However, the insurers consider the popularity of the motorcycle for theft risk after it has been sold. Therefore, for most riders, Apollino motorbikes are considered attractive options with potentially favorable insurance rates.

Some Models Generally Associated with Apollino and an Approximate Indicative Range for Expected Insurance

RFN Warrior SX-E2– usually one of the least expensive models in insurance, because it is low in displacement, and for novices in riding in general, especially with regard to liability-only insurance. Electric Dirt Bike olala MX-E150 – the premium will be a bit higher, given that the displacement is big and slightly more versatile in terms of use on mixed terrains, especially if insured for full insurance coverage.

For example, storing your bike indoors with a quality lock could reduce the risk of theft, while paying the premium once every year might eliminate monthly service fees, and completing rider training courses may offer good discounts.

Generally, you do not have to insure your dirt bike since it is used only on private property. However, theft, fire, and accidents can occur in homes and on private tracks, thus insurance would save one substantial out-of-pocket expense.

It’s fairly cheap and usually ranges from $8 to $15 per month. However, much would depend on various conditions such as your location, driving history, and age. It’s the cheapest option, but your bike will not be protected; it only covers damages or injuries you cause to others.

Most standard policies will not cover competition-related accidents. In order to have any organized races and/or timed events insurance coverage, a person will have to add a competition endorsement to their current policy or get a specialized motorsports policy. Otherwise, damage tends to occur on race day in the absence of coverage.

Generally, the smaller displacement 2-stroke engines are the least expensive type of motors to insure, considering that their market value and repair costs are minimal. However, some high-performance 2-stroke engines will have their premiums be comparable to those of the same class 4-strokes. Insurers, however, will take into consideration the capabilities of performance, cute rates of larceny, or replacement costs.

Dirt bike insurance may be a legal requirement, but it is indeed a smart investment in the future of your riding. Price depends on many factors, including your riding style, the type of bike, the location of coverage, and the level of coverage. Street-legal motorcycles are typically expensive to insure; all the same, off-road-only bikes still benefit from theft and damage cover. Hence, products are going to be available at cheap prices for Apollino riders. The important thing is comparing the different quotes, being truthful about how you utilize your bike, and opting for coverage that best fits your needs. That way, you can ride knowing you are protected against the unexpected.

APOLLO stands at the forefront as a top-tier manufacturer specializing off-road motorcycles, with the aim to spread its network worldwide. Join hands with our fantastic team. You can get instant quotes and order deliveries with the best quality products.

Connect with us today to join the ride towards innovation and explore the thrilling world of off-road adventures!

We use cookies to improve your experience on our site. By using our site you consent to cookies.